Pension Analysis for Teachers & Educators

Pension Analysis for Teachers & Educators

Detailed Pension Analysis by Experts

Retiring Edu offers the most comprehensive pension analysis to help teachers and educators plan for their retirement with confidence. Our team of financial experts will review the details of your pension, such as your years of service, salary history, and retirement options. Following a comprehensive pension analysis, our financial and insurance solution offers the critical insights to project your pension income at different retirement ages, guiding you towards smart-informed decisions about the best time to retire.

Fixed Index Annuities

Detailed Pension Analysis by Experts

Retiring Edu offers the most comprehensive pension analysis to help teachers and educators plan for their retirement with confidence. Our team of financial experts will review the details of your pension, such as your years of service, salary history, and retirement options. Following a comprehensive pension analysis, our financial and insurance solution offers the critical insights to project your pension income at different retirement ages, guiding you towards smart-informed decisions about the best time to retire.

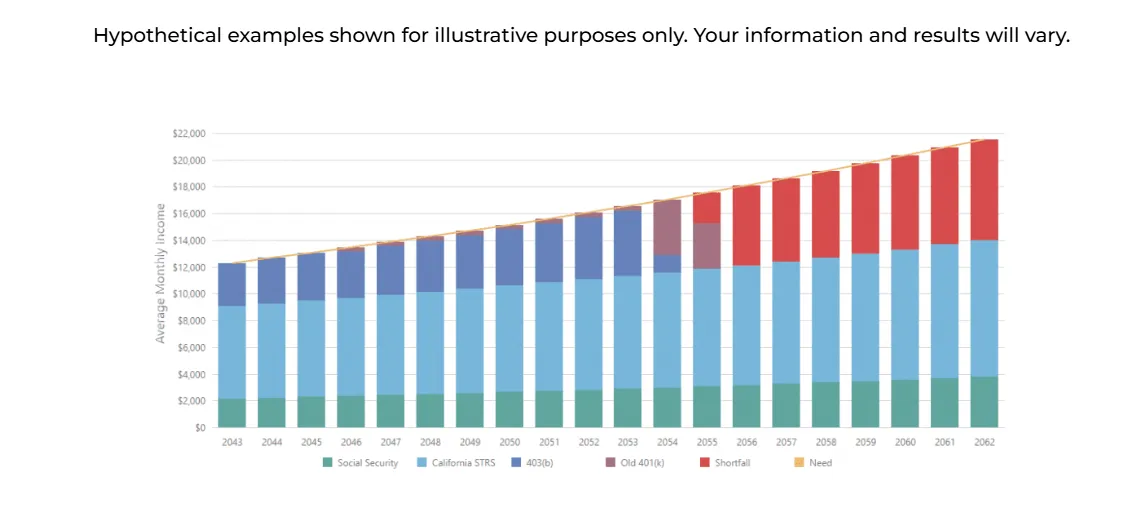

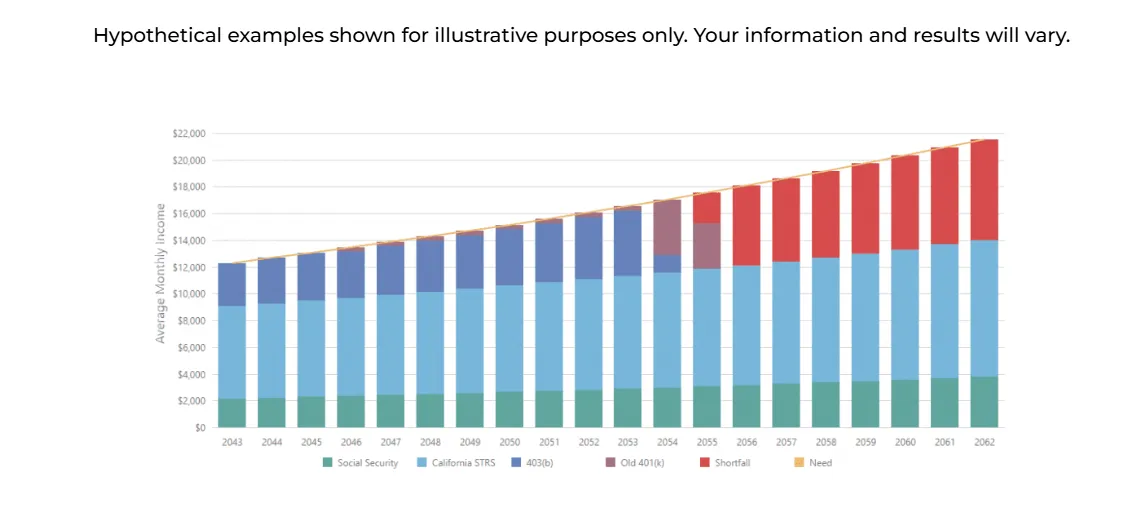

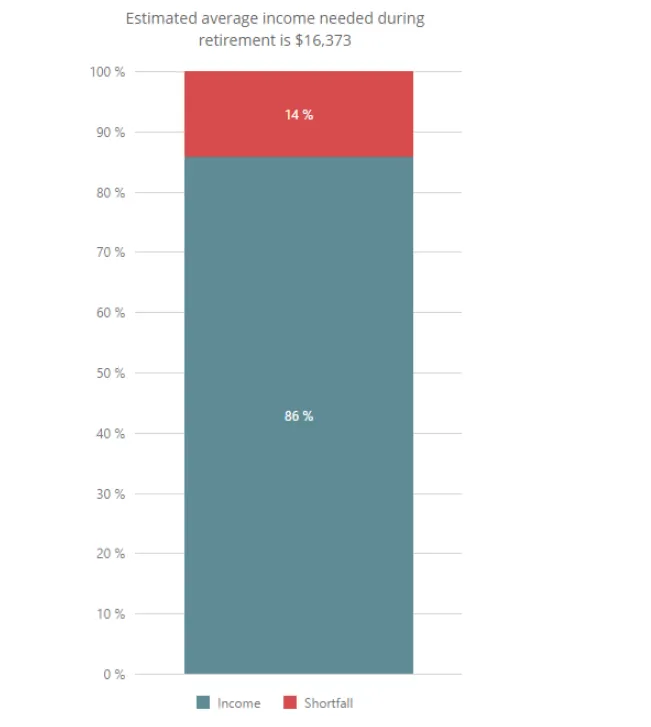

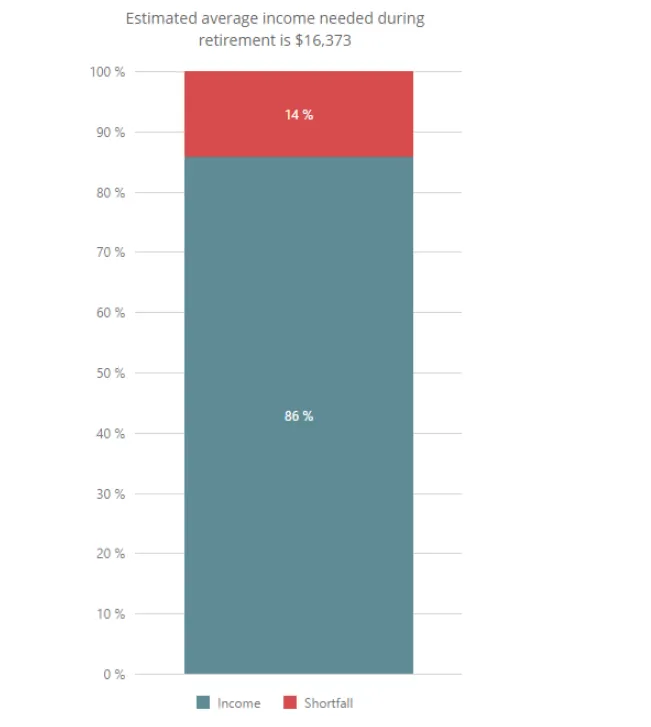

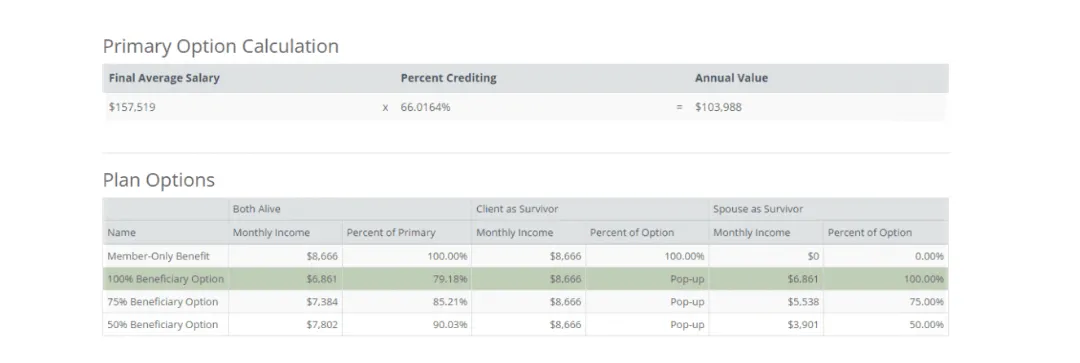

Here is a visual snapshot of the average retirement income gap, focusing on the importance of expert pension planning for teachers and educators.

Pension Analysis for Accurate Retirement Income Projections

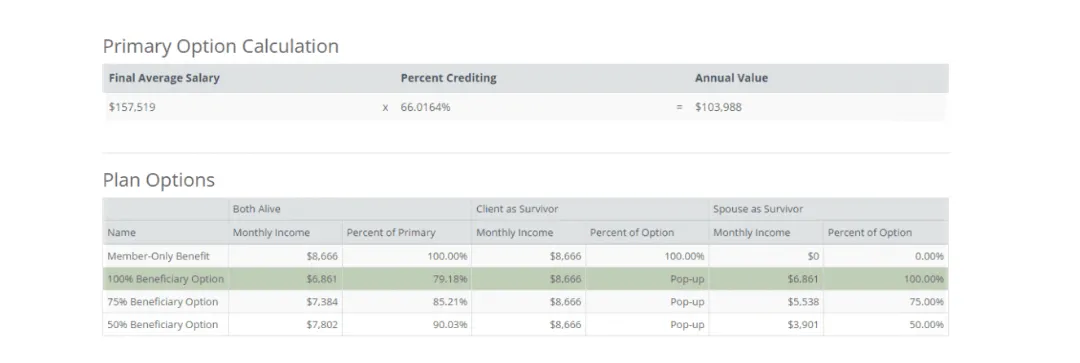

At Retiring Edu, we deliver a detailed pension analysis designed to give you accurate retirement income projections. Using a reliable retirement calculator, we illustrate potential income across various survivor and beneficiary options. You'll see clear dollar amounts and spot any financial gaps easily. The process ties right into your overall retirement planning to help you build a practical, personalized plan supporting your lifestyle and add clarity to every step of your retirement journey.

Confidential One-on-one Pension Review for Educators

Simple Visuals That Explain Complex Pension Details

Scenario Planning Based on Real Income Data

Support to Navigate Pension Decisions With Ease

Strategic Insights to Improve Retirement Confidence Early

Pension Analysis for Accurate Retirement Income Projections

Here is a visual snapshot of the average retirement income gap, focusing on the importance of expert pension planning for teachers and educators.

At Retiring Edu, we deliver a detailed pension analysis designed to give you accurate retirement income projections. Using a reliable retirement calculator, we illustrate potential income across various survivor and beneficiary options. You'll see clear dollar amounts and spot any financial gaps easily. The process ties right into your overall retirement planning to help you build a practical, personalized plan supporting your lifestyle and add clarity to every step of your retirement journey.

Confidential One-on-one Pension Review for Educators

Simple Visuals That Explain Complex Pension Details

Scenario Planning Based on Real Income Data

Support to Navigate Pension Decisions With Ease

Strategic Insights to Improve Retirement Confidence Early

The Value of Pension Analysis for Teachers & Educators

Pension analysis plays an integral role in helping teachers and educators explore their long-term income potential and make informed decisions before retiring. At Retiring Edu, we implement a retirement calculator for general, detailed pension projections. Based on those numbers, we create a plan tailored to your goals. We also offer strategies on Roth IRA, 7702 Plan, Fixed index annuities, and more to help you enjoy the retirement lifestyles you have worked hard to achieve without any financial guesswork involved.

Perks of choosing our pension analysis:

Helps you avoid common pension mistakes educators often overlook

Gives peace of mind with a clear financial retirement roadmap

Reveals how part-time years or leave periods affect total benefits

Supports decision-making during career transitions or early retirement planning

Your Roadmap to Retirement Through Pension Analysis

At Retiring Edu, we offer expert pension analysis services to help teachers as well as educators navigate service credits, retirement timelines, and benefit calculations. Our guidance supports decisions on early retirement, payout options, and pension buybacks. Each step is explained in clear terms that help you understand your choices today and how they impact your future income. These services offer real value while planning for a steady, informed path to retirement.

Our Services

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae. here

The Value of Pension Analysis for Teachers & Educators

Pension analysis plays an integral role in helping teachers and educators explore their long-term income potential and make informed decisions before retiring. At Retiring Edu, we implement a retirement calculator for general, detailed pension projections. Based on those numbers, we create a plan tailored to your goals. We also offer strategies on Roth IRA, 7702 Plan, Fixed index annuities, and more to help you enjoy the retirement lifestyles you have worked hard to achieve without any financial guesswork involved.

Perks of choosing our pension analysis:

Helps you avoid common pension mistakes educators often overlook

Gives peace of mind with a clear financial retirement roadmap

Reveals how part-time years or leave periods affect total benefits

Supports decision-making during career transitions or early retirement planning

Your Roadmap to Retirement Through Pension Analysis

At Retiring Edu, we offer expert pension analysis services to help teachers as well as educators navigate service credits, retirement timelines, and benefit calculations. Our guidance supports decisions on early retirement, payout options, and pension buybacks. Each step is explained in clear terms that help you understand your choices today and how they impact your future income. These services offer real value while planning for a steady, informed path to retirement.

Pension Projection Based on Career History

We use a retirement calculator to estimate your pension using your salary, service years, and retirement age. This projection helps you select the structure that best protects your income and beneficiaries during retirement.

Social Security Evaluation

We factor in your Social Security benefits and examine how different claiming ages impact your income. Our analysis helps you choose a strategy that supports long-term retirement stability alongside your pension.

Retirement Savings Accounts Integration

Our pension analysis software evaluates your Retirement Savings accounts, (whether is a 403b, IRA, ROTH IRA, 401K, etc); to determine how they complement your pension. We help you build a cohesive income stream using all available retirement resources.

Why Choose Retirement Edu's Pension Analysis For a Secure Future?

Retiring Edu’s pension analysis goes beyond basic estimates. We provide personalized projections, explore payout strategies, and review additional income sources like Social Security and IRAs. Every analysis is designed to uncover gaps, clarify options, and support smarter planning. Our goal is to help you retire with confidence, knowing your decisions are based on real numbers.

Decades of Experience Serving Teachers & Educators

Dedicated Support Throughout Your Planning Journey

Easy-to-follow Reports for Better Decisions

A Responsive Team is Ready to Answer Questions

Fast Turnaround With Clear, Concise Results

Delaying retirement savings increases the required monthly contributions, making early planning through pension analysis a financially smarter choice.

Frequently Asked Questions

How is my teacher pension calculated?

Your pension is based on your years of service, final average salary, and a benefit multiplier. Each state or plan may use slightly different formulas to determine the amount.

Will early retirement reduce my pension benefits?

Absolutely! Retiring before your plan’s full retirement age can reduce monthly payments. Pension analysis helps you understand these reductions and compare scenarios to make the most informed decision.

Can I include service buybacks in the analysis?

Pension analysis reviews service buyback opportunities and calculates how added service years may increase your pension income, helping you decide if the cost is worth the benefit.

What are the main services you offer at Retiring Edu?

At Retiring Edu, we offer services in retirement planning with Roth 403(b), Roth IRA, 7702 plans, Fixed Index Annuities, Life Insurance, and Long-term Care Insurance, tailored to teachers and educators’ long-term financial goals.

Does pension analysis consider Social Security benefits?

At Retiring Edu, we factor in your Social Security eligibility and help you understand how different claiming ages affect your total retirement income. This provides a complete picture of your benefits.