Frequently Asked Questions

Pension Analysis for Teachers & Educators

Detailed Pension Analysis by Experts

Retiring Edu offers the most comprehensive pension analysis to help teachers and educators plan for their retirement with confidence. Our team of financial experts will review the details of your pension, such as your years of service, salary history, and retirement options. Following a comprehensive pension analysis, our financial and insurance solution offers the critical insights to project your pension income at different retirement ages, guiding you towards smart-informed decisions about the best time to retire.

Pension Analysis for Accurate Retirement Income Projections

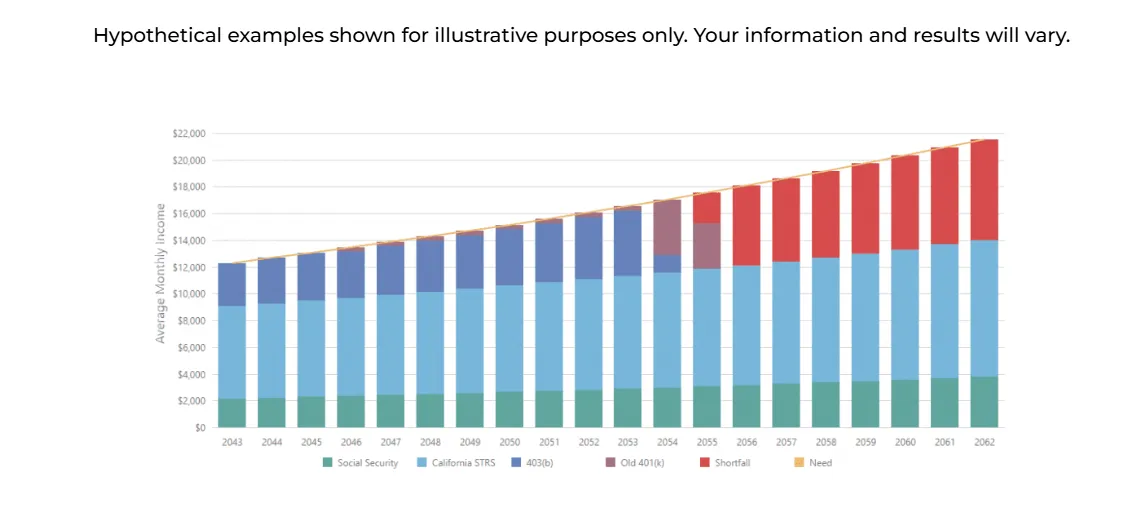

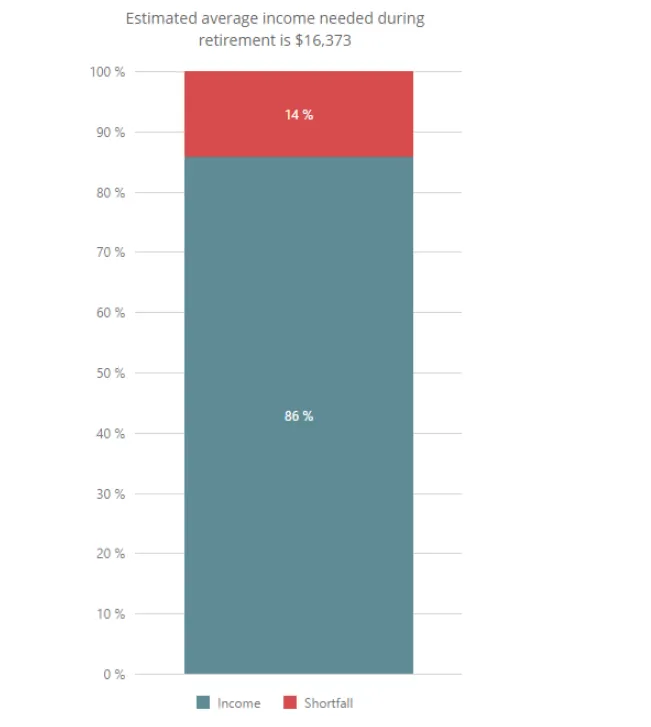

Here is a visual snapshot of the average retirement income gap, focusing on the importance of expert pension planning for teachers and educators.

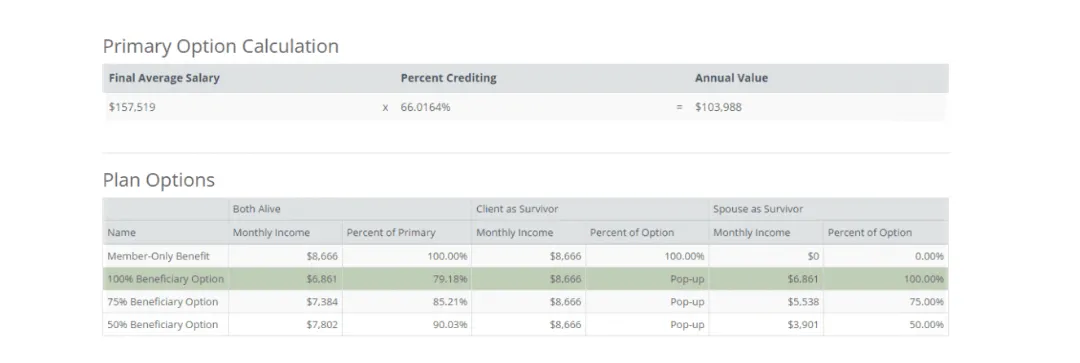

At Retiring Edu, we deliver a detailed pension analysis designed to give you accurate retirement income projections. Using a reliable retirement calculator, we illustrate potential income across various survivor and beneficiary options. You'll see clear dollar amounts and spot any financial gaps easily. The process ties right into your overall retirement planning to help you build a practical, personalized plan supporting your lifestyle and add clarity to every step of your retirement journey.

Confidential One-on-one Pension Review for Educators

Simple Visuals That Explain Complex Pension Details

Scenario Planning Based on Real Income Data

Support to Navigate Pension Decisions With Ease

Strategic Insights to Improve Retirement Confidence Early

Our Services

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae. here

The Value of Pension Analysis for Teachers & Educators

Pension analysis plays an integral role in helping teachers and educators explore their long-term income potential and make informed decisions before retiring. At Retiring Edu, we implement a retirement calculator for general, detailed pension projections. Based on those numbers, we create a plan tailored to your goals. We also offer strategies on Roth IRA, 7702 Plan, Fixed index annuities, and more to help you enjoy the retirement lifestyles you have worked hard to achieve without any financial guesswork involved.

Perks of choosing our pension analysis:

Helps you avoid common pension mistakes educators often overlook

Gives peace of mind with a clear financial retirement roadmap

Reveals how part-time years or leave periods affect total benefits

Supports decision-making during career transitions or early retirement planning

Your Roadmap to Retirement Through Pension Analysis

At Retiring Edu, we offer expert pension analysis services to help teachers as well as educators navigate service credits, retirement timelines, and benefit calculations. Our guidance supports decisions on early retirement, payout options, and pension buybacks. Each step is explained in clear terms that help you understand your choices today and how they impact your future income. These services offer real value while planning for a steady, informed path to retirement.

What does Retiring Edu help teachers and educators with specifically?

Retiring Edu helps teachers and educators understand their pensions, retirement benefits and we help them plan for a more comfortable retirement. It simplifies challenging topics by connecting users to licensed experts specializing in retirement planning for teachers,

school staff, and education-sector employees throughout their career stages.

How can I book my complimentary Pension & Retirement Analysis?

It is easy to book your complimentary Pension and retirement Analysis. Click here to submit your name, state, email, and phone number. We will contact you to schedule your sessions. To get accurate projections, ensure you have a recent pay stub and your hire date or service credits handy.

Can Retiring Edu help if I’m still years away from retirement?

Absolutely! We help early—and mid-career teachers and educators build a long-term plan. Starting sooner means making smart choices around insurance, savings, and tax strategies. Personalized consultations help align your current benefits with future goals for confident retirement planning. Contact us to explore the personalized strategies based on your years of service.

When should I start contributing, and is it too late if I’m nearing retirement?

The best time depends on your future goals. Our analysis will reveal how different timelines impact the results. Although early planning can help with growth, we offer proven strategies tailored for those who are starting late in their teaching career.

Are you tied to one provider or a specific company?

No. We work with around ten reliable providers. This widespread access helps us to explore several retirement options and recommend solutions that better align with your personal financial goals and school district benefits.