Long-Term Care Costs

Long-Term Care Costs

Address potential long term illness issues

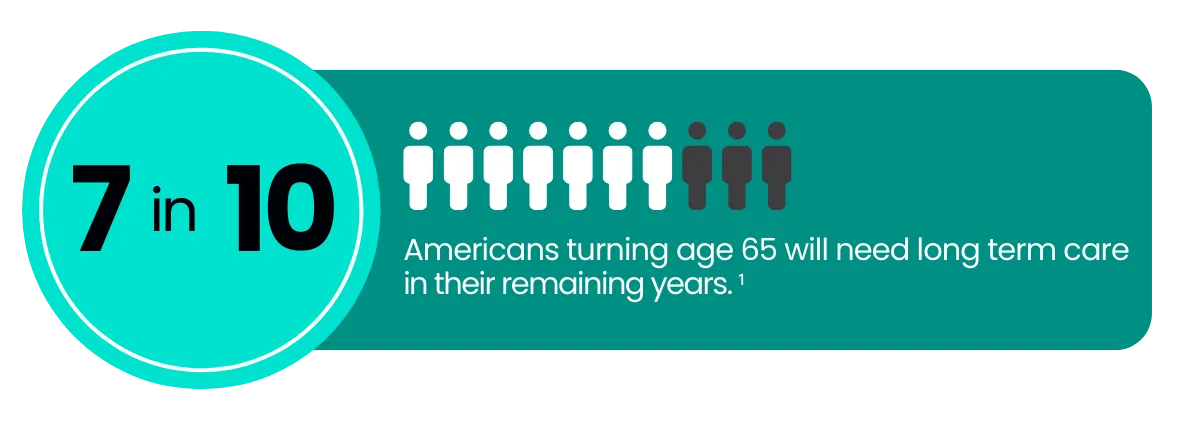

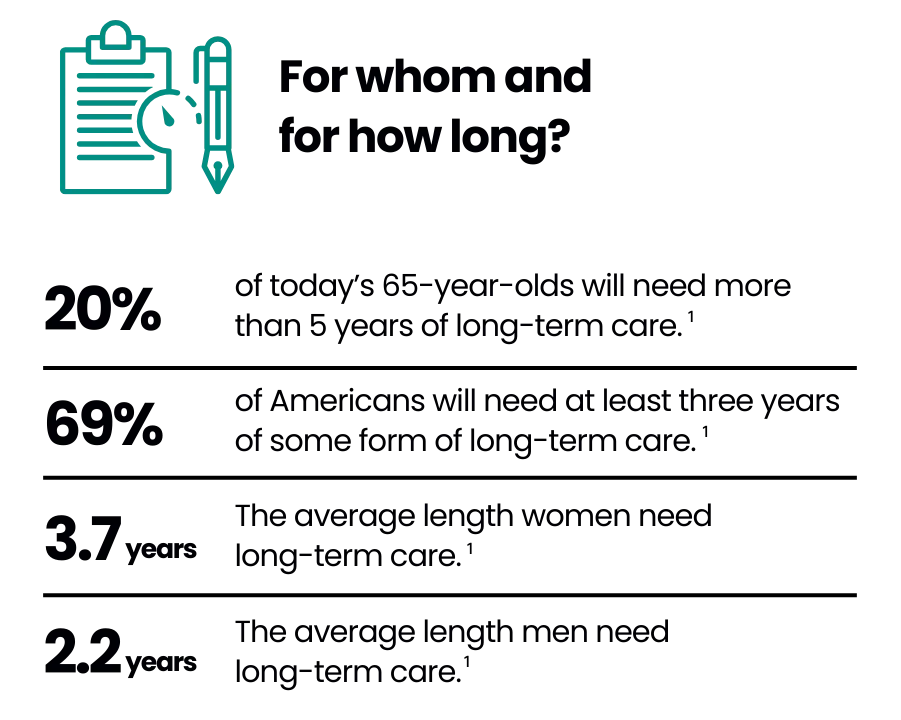

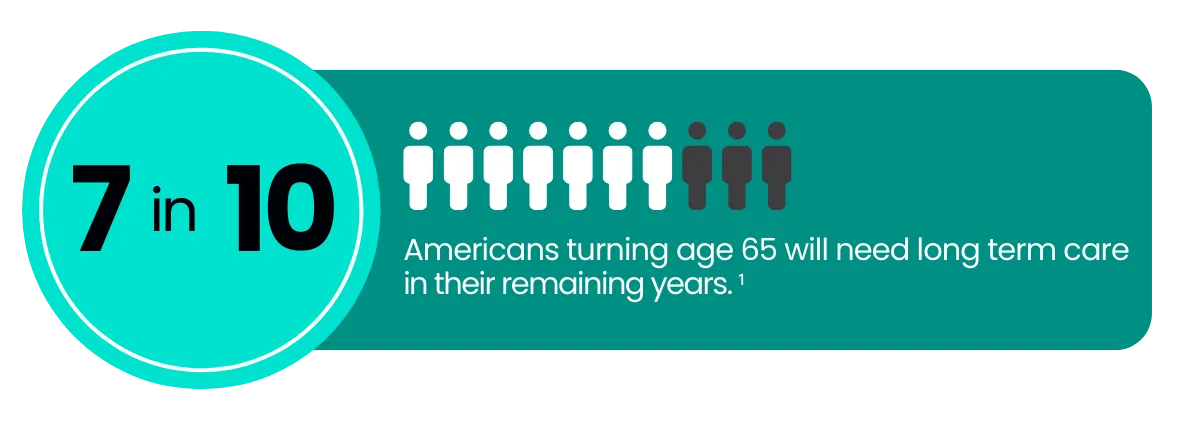

Help protect your savings and retirement plans from health care costs. The need for care grows as you age, and it's important to protect your future expenses relating to illness.

Help protect your savings and retirement plans from health care costs. The need for care grows as you age, and it's important to protect your future expenses relating to illness.

Give yourself more flexibility

Life insurance can offer enhanced features that can help cover the costs of expenses like nursing homes, home health care aides, assisted living and more.

*Health care riders on life insurance policies may be optional and include an additional annual cost. Additional underwriting may be required. These features are NOT a replacement for long-term care insurance

1. How Much Care Will you Need? February 2020. https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

2. Cost of Care Trends & Insights. February 2022. https://www.genworth.com/aging-and-you/finances/cost-of-care/cost-of-care-trends-and-insights.html

3. Caregiving. November 2021. https://www.genworth.com/aging-and-you/family/caregiving.html

Address potential long term illness issues

Help protect your savings and retirement plans from health care costs. The need for care grows as you age, and it's important to protect your future expenses relating to illness.

Give yourself more flexibility

Keep your options open if certified with a qualifying condition by a licensed health care practitioner. Unlock a portion of your life insurance benefits while you're facing expenses like nursing homes, home health aides, assisted living and more.

Give yourself more flexibility

Life insurance can offer enhanced features that can help cover the costs of expenses like nursing homes, home health care aides, assisted living and more.

*Health care riders on life insurance policies may be optional and include an additional annual cost. Additional underwriting may be required. These features are NOT a replacement for long-term care insurance

1. How Much Care Will you Need? February 2020. https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

2. Cost of Care Trends & Insights. February 2022. https://www.genworth.com/aging-and-you/finances/cost-of-care/cost-of-care-trends-and-insights.html

3. Caregiving. November 2021. https://www.genworth.com/aging-and-you/family/caregiving.html

Retiring Edu DBA For Teachers Financial & Insurance Solutions

Retiring EDU is an Insurance Firm that offers retirement income and protection strategies using life insurance and annuity products. Our services focus on the financial needs of educators and school employees, and include a complimentary pension analysis. Our licensed insurance professionals are independent and can offer a wide array of insurance products and services to help meet your unique needs. CA insurance license #6002118.

We are not affiliated with any educational or government agency, and do not provide investment, tax or legal advice. Always consult with your own qualified investment and tax/legal advisors.

Insurance and annuity products are not suitable for everyone. They involve fees and charges, including possible surrender penalties. Optional benefits and riders may involve additional annual cost. Life insurance involves medical and often financial underwriting to qualify.

Life insurance loans and withdrawals will reduce policy death benefits and cash values and may cause the policy to lapse or require additional premiums to keep the policy in-force.

Annuity withdrawals are subject to ordinary income taxes, and potentially a 10% IRS penalty before age 59-1/2. Product feature and availability may vary by state.

Fixed indexed life insurance and annuities are not investments in the market or index. The interest credited on your contract may be affected by the performance of an external index. However, your contract does not directly participate in the index or any equity or fixed interest investments. You are not buying shares in an index. Interest credits are subject to limits set by the issuing company, such as caps, spreads and/or participation rates. Guarantees are backed by the financial strength of the issuing company.